In today’s complicated financial landscape, navigating your investments and financial planning can feel overwhelming. This is where the knowledge and expertise of a financial adviser come into play. By comprehending what a financial adviser does, how they charge for their services, and when to seek their guidance, you can make informed decisions that align with your financial goals. With their support, you can approach investing with confidence, guaranteeing you are prepared for both expected and unexpected life events.

Picking the right financial adviser is a crucial step in securing your financial future. With numerous options available, including fiduciary advisers and robo-advisers, it’s essential to know the differences and what to look for in a trusted professional. In this article, we will explore the various roles that financial advisers play, the benefits of collaborating with them, and how they assist in strategic planning for retirement, tax obligations, and even estate planning. Whether you are a small business owner or an individual planning for your future, understanding the value of a financial adviser can enable you to take control of your financial destiny.

Comprehending the Role of Monetary Advisors

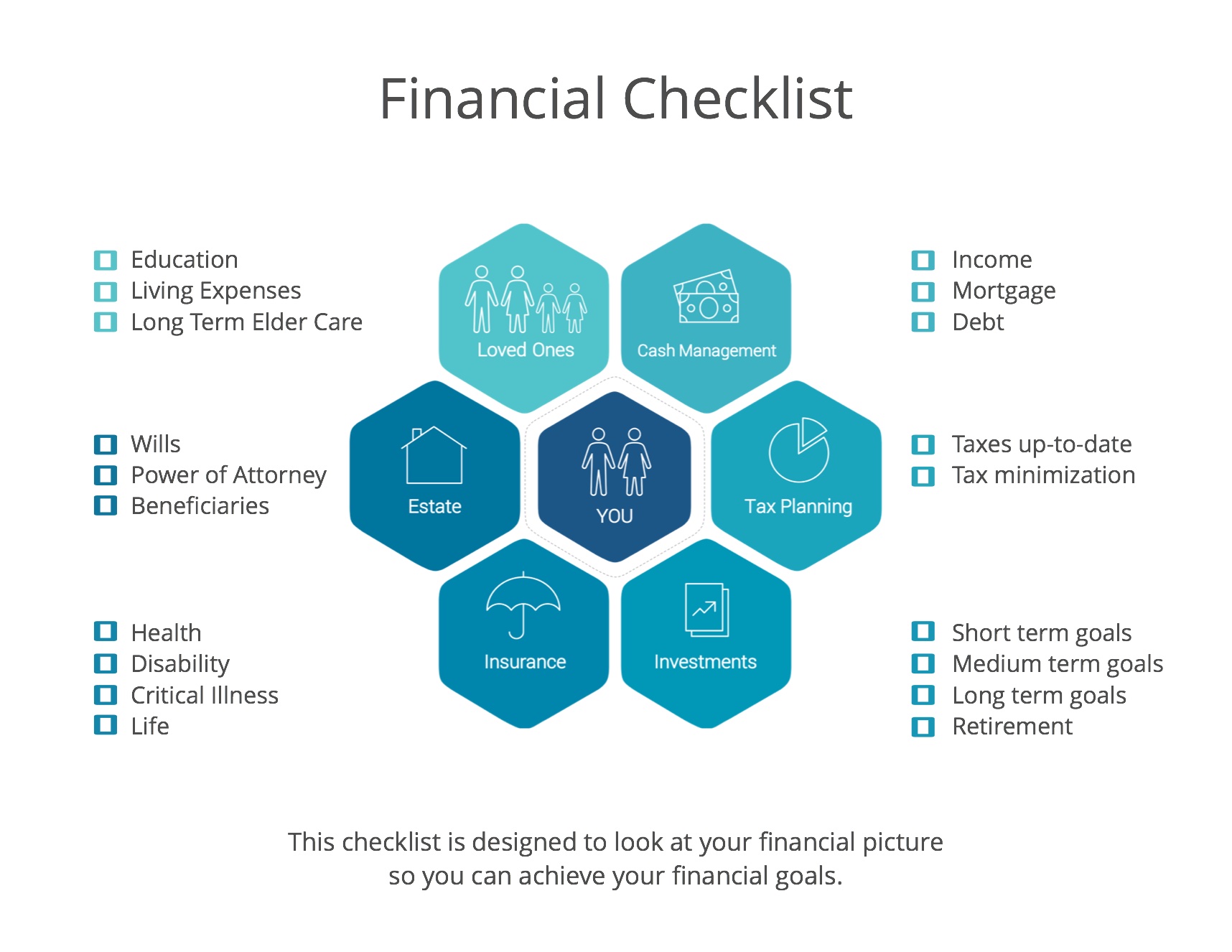

Investment advisors play a critical function in helping people and households navigate the intricacies of personal financial matters. They deliver professional assistance on multiple monetary issues, including investment management, retirement planning, tax strategies, and estate planning. By understanding their clients' financial objectives and risk tolerance, advisers develop personalized plans that match with their clients' needs. This personalized method ensures that individuals are not only informed but also assured in their monetary choices.

Another important aspect of a investment consultant’s function is to educate clients about monetary products and market trends. Advisers ensure their customers up-to-date about changing market conditions and market factors that could affect their portfolios. They outline the possible risks and rewards of different investment possibilities, helping individuals make educated determinations. By simplifying complex financial concepts into understandable terms, monetary advisors empower their individuals to take an active role in controlling their financial prospects.

Finally, investment consultants act as a pillar of responsibility and support, especially during instances of financial volatility or significant life changes. They support individuals stay focused on their long-term objectives, guiding them through emotional reactions to market fluctuations. No matter if facing professional changes, significant purchases, or retirement, consultants extend steady guidance and assistance, ensuring clients remain aligned with their monetary goals even amidst instability.

Picking the Right Monetary Adviser

Selecting a monetary adviser is a vital action in ensuring your monetary prospects. Start by identifying the particular services you require, whether it is it's capital oversight, retirement strategy, or estate strategies. Understanding your monetary goals will help limit your choices and ensure that the adviser you select has the necessary expertise to address your individual needs. It is also vital to evaluate their credentials and experience to verify they have the required skills.

After establishing your needs, conduct comprehensive investigation to create a list of potential candidates. Take attention to their cost structures, as financial advisers may bill in different methods including per hour rates, flat charges, or percentage structures. Look for transparency in their charges and favor those who explain their expenses clearly. Additionally, check reviews and testimonials from former customers to assess their reputation and the quality of service they provide.

In conclusion, schedule interviews with your preferred choices to assess their communication approach and methodology to monetary advising. Ask relevant inquiries about their investment strategy, how they handle market fluctuations, and their background with customers in similar situations to yours. This meeting is an great opportunity to determine if you are at ease with them, as a good advisor-client relationship is built on confidence and understanding. Selecting the right financial advisor demands thorough consideration, but it can lead to significant benefits for your financial health.

Maximizing the Benefits of Financial Advisers

To truly optimize the outcomes of partnering with a financial adviser, it is essential to establish clear and forthright communication from the beginning. Clients should feel free sharing their financial goals, issues, and ambitions, as this forms the foundation of a customized financial strategy. Consistently scheduled check-ins allow clients and advisers to review goals and make essential adjustments based on shifts in individual circumstances or market conditions. This persistent dialogue fosters a collaborative relationship and ensures that the financial plan remains aligned with the client’s developing needs.

One more effective way to strengthen the relationship with a financial adviser is to proactively participate in the financial planning process. Engaging in dialogues about investment strategies, risk tolerance, and economic understanding not only helps clients gain a more thorough understanding of their financial situation but also empowers them to make informed decisions. Advisers typically favor clients who seek information and desire to understand, as this collaboration can lead to more tailored solutions that align with the client’s unique situation.

Ultimately, harnessing technology can greatly enhance the partnership between clients and financial advisers. Employing financial planning software and apps allows clients to manage their progress, control budgets, and view their investment portfolios in real time. Technological advancements create a simpler efficient, transparent experience and can provide clients with easy access to vital financial data. By accepting The original source and modern technology, individuals can fully benefit on the expertise given by financial advisers to achieve their financial goals successfully.